With under a week until the 2020 US Presidential elections on Tuesday, 3 November, economists and investors are looking to predict the way various outcomes could affect Australian businesses.

The US economy is the world’s largest economy, and Australia has a very close economic relationship with the USA. In 2016 alone, exports to Australia generated 264,000 US jobs and in more than 15 states Australia ranks among the top 10 export destinations. While the large changes that come from a US election won’t directly impact Australians, the election still has the potential to influence Australian businesses and the wider economy.

OFX Head of Treasury and a London School of Economics-trained 15-year veteran of global currency markets, Sebastian Schinkel, has said that the volatility of the markets and the uncertainty of the US election outcome will have a large impact on the US economy, and consequentially Australian businesses.

“The US dollar is effectively the world’s reserve currency with many countries including China and the Middle East conducting business deals in USD rather than local currencies,” Mr Schinkel said. “And while the USD value is impacted by the ongoing challenges and the election in the US, the pervasive nature of the USD will inevitably impact the global currency markets.

“The events in the US have an outsized impact on global markets. For those Australian SMEs engaging in cross-border trade and buying or selling goods or services in US dollars could need to protect against likely currency volatility as the markets react to the election results.”

With Joe Biden currently leading in both the national and battleground state polls, the US is expecting the election to result in Democratic victory.

“A Democratic win could soften the US foreign policy and increase social spending which could weaken the US dollar,” said Mr Schinkel. “Expectations the Democrats will regain a majority in both house and senate have raised hopes of an extensive stimulus bill in the new year.”

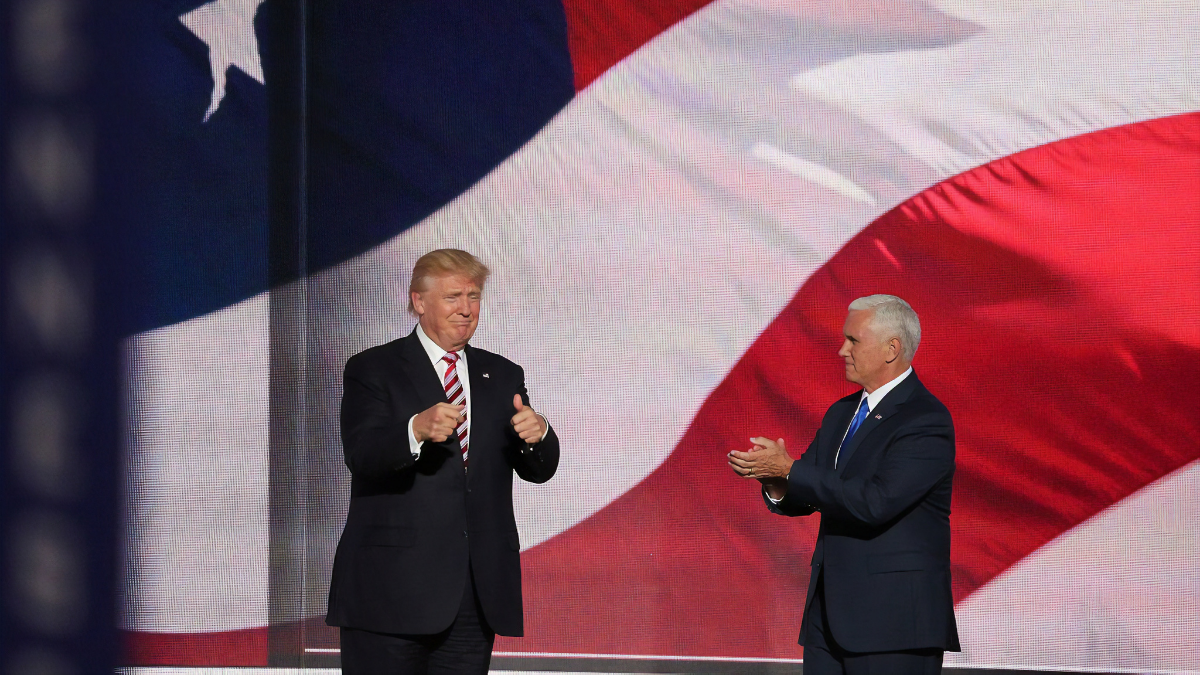

However, Mr Schinkel says that if the Republican leader were to win the election, or if he were to contest Biden’s victory, it could mean the US dollar temporarily picks up.

“In the event of any uncertainty that moves away from what the market is expecting, which is a Biden win, I will think that the US dollar will pick up.”

Mr Sebastian Schinkel, OFX Head of Treasury

“If the Republicans win a second term, the US Dollar will weaken in the long term but uncertainty will strengthen the USD in the short term.”

“In the event of any uncertainty that moves away from what the market is expecting, which is a Biden win, I will think that the US dollar will pick up. The question is, for how long?”

“The US dollar will pick up because of risk, due to people getting nervous and because of the potential risk of not having a clear winner.

“It’s not as straightforward as it should be, because Trump can go and say, “Hey, you know, that mail-in vote in Florida, I think it’s not valid. I’m going to sue that” and then that can go to the Supreme Court. Now that the Supreme Court has a huge conservative majority it could rule in favour of Trump.

“In that scenario, I feel like the US dollar will go up, but in my opinion only temporarily, because I feel like the fundamentals are placed for the US dollar to go down into the medium term.

“And so depending on the different scenarios, I will say that a Trump win, or even a democratic win by Biden with a Republican senate could cause equities to go down and then force people will jump onto the US dollar, because it’s a safe haven, causing it to pick up.”

Mr Schinkel has also highlighted the effect the US election result will have on Australia’s relationship with China, and how that could impact Australia’s foreign investment and trade.

“Australia has really a lot of dependence on China. We depend on China’s growth and because of the commodities we sell to them,” he said.

“If Biden gets away with a win, then investors are expecting the relationship between US and China to improve and to settle down a little bit, and I think that will put Australia in a better position globally.”

“If Trump were to take out the election, then we may see Australia having to choose between two major economical superpowers.”

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.